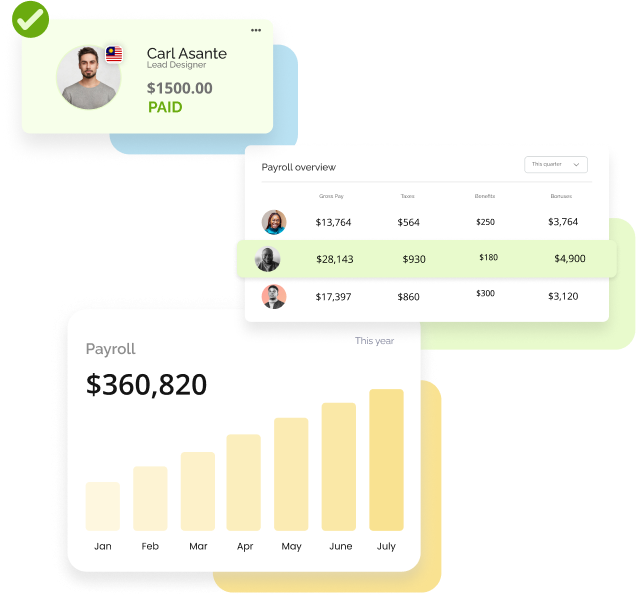

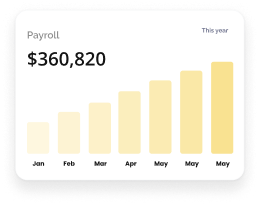

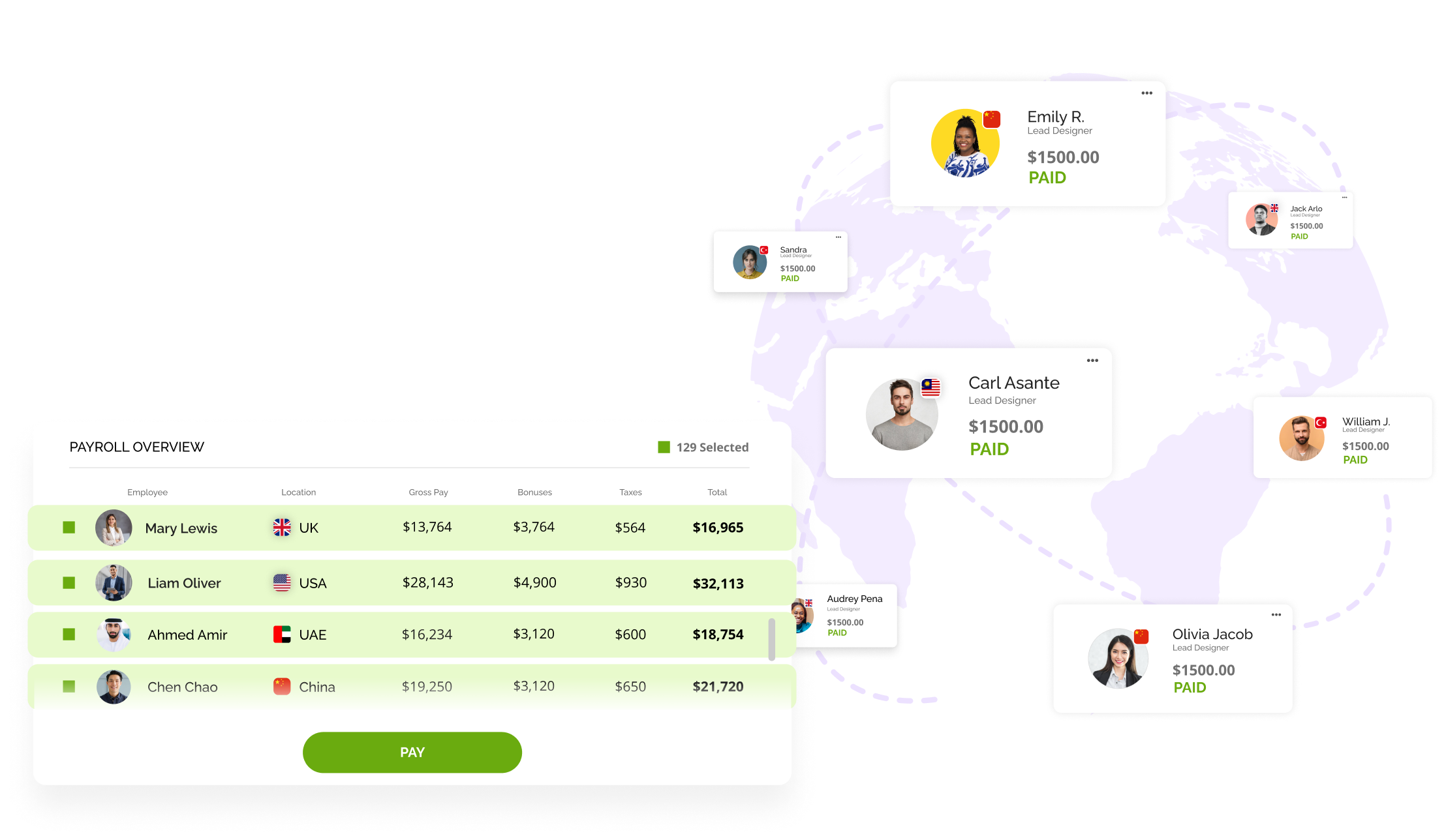

Remire’s payroll service includes comprehensive management of your global payroll needs, ensuring compliance with local regulations. We handle everything from accurate payroll calculation, tax deductions, and filings to detailed payroll reporting and employee payment distributions. Additionally, our services support multi-currency payments and provide customizable payroll cycles to match your business requiremen

Remire ensures compliance with local payroll regulations by leveraging our expertise in global employment laws and maintaining up-to-date knowledge of regulatory changes in each country. We partner with local experts to manage payroll calculations, tax withholdings, and filings accurately according to regional laws.

Yes, Remire is equipped to manage payroll for both local and international employees. Our platform is designed to handle the complexities of global payroll management, including compliance with local and international tax laws, multi-currency transactions, and varying payroll regulations. Whether your team is situated in one country or spread across multiple continents, Remire ensures that every payroll process is seamless and compliant.

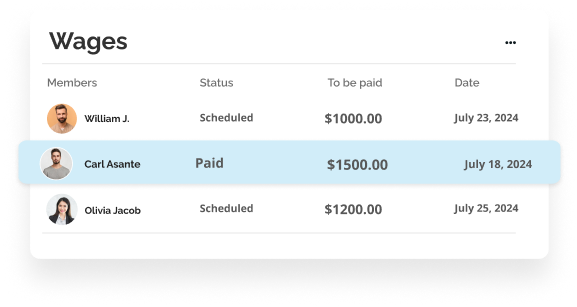

Yes, Remire offers same-day payments as part of our global payroll management services to ensure timely and efficient wage distribution. This feature is designed to help businesses meet urgent payroll needs and maintain positive relationships with their employees by ensuring that payments are processed quickly, on the agreed-upon date, without delays.

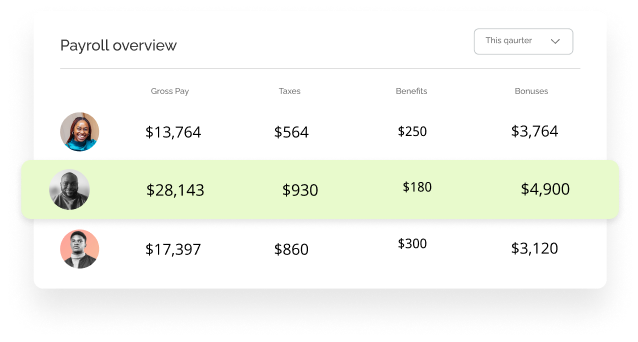

Yes, Remire provides comprehensive support for handling payroll taxes. We manage the calculation, deduction, and filing of payroll taxes according to the local regulations of each country where your employees are located. Our team ensures that all tax obligations are met accurately and on time, reducing the risk of compliance issues and penalties.